Using drug & alcohol rehab insurance doesn't have to be difficult!

Understanding the financial aspects of addiction treatment is crucial to obtaining support and starting recovery. At Banyan Treatment Centers, we want to take the stress out of the recovery process by streamlining the rehab insurance verification process. As such, we offer a helpful online tool that can help you find out if rehab is covered by insurance. This cutting-edge service takes the guesswork out of finding treatment and offers online access to frequently asked questions about insurance for addiction treatment. If you’re interested in beginning the recovery process, keep reading to learn more about the insurance we accept at Banyan rehab locations and how to verify your drug and alcohol rehab insurance today.

Fill Out the Form Below to Find Out If Your Insurance Covers Our Treatment

* If you do not have health insurance, we offer different financing options.

Rehab Insurance Verification. Simplified.

Our top goal is to quickly connect you to the help you need. For this reason, Banyan Treatment Centers developed an online health insurance verification tool that provides real-time estimates of your out-of-pocket maximums, coinsurance percentages, and in-network and out-of-network deductibles. If you want to find out whether your insurance covers rehab, please take a moment to complete our form. You will receive your results instantly and at no cost. As soon as we receive your information, one of our intake coordinators will contact your insurance company to verify your coverage. Once they're done, they'll reach out to you to discuss the next steps in your recovery.

Health Insurance Basics

Banyan Treatment Centers’ health insurance verification estimates your in-network and out-of-network coverage within seconds. However, there are various aspects of health insurance you should know when researching insurance that covers rehab. To help you understand the complexities of the verification process, below is more on the parts of a health care plan:

What is a Deductible?

A health insurance deductible is the amount an individual must pay out of pocket for covered healthcare services before their insurance plan begins to contribute to the costs. For instance, if a health insurance plan has a $1,000 deductible, the policyholder bears the financial burden of covering the first $1,000 in qualified medical costs. Once this deductible is met, addiction treatment insurance coverage typically kicks in, and the plan starts sharing the costs with the policyholder through copayments, coinsurance, or other arrangements, depending on the specific terms of the insurance policy. Deductibles are usually an annual responsibility, resetting at the beginning of each calendar year.

Examples of Copayment

A copayment in health insurance, commonly known as a copay, is a fixed amount that an individual pays for a covered healthcare service, typically due at the time of service. Unlike a deductible, which represents an initial out-of-pocket expense, a copayment is a specific, predetermined fee for specific medical services. For example, if a health insurance plan has a $50 copayment for doctor's office visits, the policyholder would have to pay $50 each time they saw a doctor while the insurance plan pays for any remaining charges. Copayments vary for different services and are designed to share the costs of healthcare between the individual and the insurance provider.

Coinsurance

Coinsurance is a cost-sharing arrangement in which, once the deductible is paid, a portion of covered medical expenses is split between the policyholder and the insurance provider. It shows the portion of a covered healthcare service's total cost that the policyholder is responsible for covering. For instance, if the entire cost of a hospital stay is $20,000 and a health insurance plan has a 20% coinsurance for hospital stays, the policyholder would be responsible for paying $4,000 (20% of $20,000), with the insurance company covering the remaining $16,000.

Out-of-Pocket Maximum

The out-of-pocket maximum is the most that a person with health insurance is required to pay out-of-pocket for approved medical services during a specific time frame, typically a calendar year. Generally, the insurance plan pays for all remaining covered expenses for that period after the out-of-pocket maximum is reached. This covers coinsurance, deductibles, and copayments. For instance, if a person has paid $5,000 in deductibles, copayments, and coinsurance during the year and their health insurance plan has a $5,000 maximum out-of-pocket, the insurance plan would pay all remaining costs for covered medical services for the remainder of the year.

Policy Effective Date

When it comes to health insurance, the policy’s effective date is the day the coverage starts and is activated. It establishes the policyholder's initial eligibility for benefits and coverage for medical services according to the terms of the insurance plan. For instance, if the policy effective date is February 1, 2023, a policyholder can start using their coverage for qualified medical expenses on that date. To guarantee they can access the benefits specified in their insurance plan, people must be aware of the policy effective date, which is a critical component of insurance enrollment.

You've got questions, we've got answers!

Does Banyan Treatment Centers accept my insurance for addiction treatment?

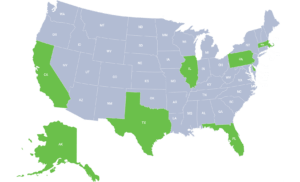

Every healthcare policy is different, which is why we recommend you use our insurance verification tool or give us a call. We need to verify your policy details before we can admit you into one of our addiction treatment facilities. Fortunately, Banyan Treatment Centers accepts more insurance providers.

Banyan accepts the following insurance providers:

- Aetna

- Ambetter

- AmeriHealth

- Anthem

- AvMed

- BlueCross BlueShield

- Beacon Health Options

- CareFirst

- Cigna

- ComPsych

- FirstHealth

- Geisinger

- GHI

- Uprise Health

- HMC HealthWorks

- Humana

- Keystone First

- Magellan Healthcare

- Medcost

- Medical Mutual

- MWN

- Multiplan

- Oscar

- Tricare

- TRPN (Three Rivers Provider Network)

- Tufts Health Plan

- Value Options

- Western Health Advantage

Please call to verify your coverage or check with your health insurance carrier to determine coverage regarding specific services. If you do not see your insurance on the list above, we encourage you to call us to learn more about possibly setting up a payment plan.

Interested in setting up a payment plan?

What will my insurance pay?

While many insurance companies cover addiction and mental health treatment, certain limitations may apply:

- The policy may only cover certain levels of care, such as medical detox and outpatient programs, but not inpatient care.

- The policy may cover only certain types of facilities.

- The policy might only pay for services for a predetermined amount of time, like treatment plans that last 30, 60, 90, or 120 days.

- Treatment may be restricted by the policy to a set number of days each year or lifetime.

- The policy may limit treatment to a certain number of days per year or per lifetime.

- Only treatment centers within the policy's approved provider network may be covered. This implies that you might have to pay for all of the services you receive, or you might have to pay a higher copayment if you visit an out-of-network provider.

- Your policy itself, as well as your insurance company, will determine the extent of your coverage.

The extent of your coverage will depend on your policy and insurance company. Talking to your insurance provider directly or consulting your policy handbook are the best ways to find out exactly what your insurance will cover.

How do I know if my insurance covers substance abuse treatment?

To find out if you’re covered under an insurance policy, call your insurance company’s toll-free number. The number can be found on your insurance card or online. If you don’t understand the basics of healthcare insurance, such as copayments and out-of-pocket maximums, our intake or insurance verification specialists can help you understand your financial responsibilities and coverage.

How do I verify my health insurance benefits?

You can fill out our form above to verify your health insurance benefits. Once you’ve filled out the form, your coverage information will be obtained from your healthcare provider. Because every healthcare policy is different, our healthcare verification specialists will reach out to your provider to verify that your results are accurate. This is a free service offered to all new patients.

Can you explain the results of my insurance verification?

In the Insurance Basics section, you’ll find more information regarding the basics of healthcare coverage, including deductibles, copayments, coinsurance, and out-of-pocket maximum. If you still have questions, an intake coordinator can offer more information.

Who do I call if I have additional questions about my rehab insurance coverage?

If you still have additional questions regarding your coverage benefits, we recommend you call your insurance company directly.

How much does rehab cost with insurance?

Ultimately, the cost of rehab depends on the type of treatment center, the type of treatment, and the extent of coverage offered by the individual’s health insurance policy and company. While some recovery options are entirely free, such as non-profit health clinics, luxury addiction treatment centers for celebrities and executives might cost up to $80,000 per month. However, standard addiction treatment can cost anywhere from $2,000 to $30,000.

How much does rehab cost without insurance?

The cost of rehab without insurance may vary depending on the type and length of treatment as well as the state in which the individual receives care. For instance, medical detoxification programs can cost anywhere from $300 to $900 per day, to $1,500 to $4,000 for an average of a week. Outpatient treatment may cost anywhere from $1,000 to $10,000, intensive outpatient may cost between $3,500 and $11,000, partial hospitalization programs may cost between $7,000 and $20,000, and residential programs may cost between $6,000 to $25,000, the latter of which is more typical of luxury rehabs. There may also be additional costs to consider, such as admission fees, detox, pharmacotherapy, longer treatment, and aftercare support.

Do you have a rehab payment plan if my insurance doesn’t pay?

The availability of a rehab payment plan depends on various factors. To receive the most accurate answer, call one of our addiction treatment centers at 888-515-7705 to speak to a recovery insurance verification specialist.

Don't Let Insurance Worries Stop You from Getting Treatment.

We Accept Most Insurances

At Banyan Treatment Centers, our goal is to make sure that anyone who needs treatment from drug and alcohol addiction are able to get the help needed to assist them on the road to recovery. If you don't have insurance contact us to inquire about alternate methods regarding treatment for yourself or a loved one.

Is your provider not listed? Don't worry, we can still help you or your loved one.